We live in a global, competitive world. Differentiating oneself through a powerful brand image that conveys one’s values and commitment today is more necessary and indispensable than ever. companies have known this for many decades. However, only recently have governments begun to consider the country brand and its reputations as one of the main assets of a nation.

A strong brand helps build a company’s reputation among its stakeholders. The same is true when it comes to the country brand. In the minds of its stakeholders (whether these are tourists, investors, corporations, international regulators or other governments), this reputation operates as a shortcut. expressed in economic terms, it reduces transaction costs, making decision- making processes faster and easier in terms of everything related to that country.

Think for a moment of a country positioned as an attractive tourist destination. no doubt it will be much easier for it to attract visitors and increase revenues through this channel than another country that is not viewed as being such an attractive destination. Think now of a country perceived as a safe place to invest. This circumstance will help it to attract capital, talent and access to finance in international markets with much more favourable conditions than those that our tourist power can achieve. Both countries have something in common: their good reputation.

A strong brand helps build a company’s reputation

In the Reputation economy in which we compete today, the perceptions of stakeholders, i.e. the good or bad reputation of a country, influence their behaviours and attitudes towards those countries. Think of Greece and Germany, and the very different conduct we have towards one or the other.

In turn, the attitudes of the stakeholders have a direct impact on the Gross Domestic Product (GDP) of a country. The business press reminds us every day of the difference between 10-year Spanish bonds and German bonds. It is the risk premium that results from the increasingly poor reputation of the solvency of Spanish debt. In contrast, some German bond auctions have even shown a negative interest. Understand the latter as the bonus of the good reputation of its debt. The essence of reputation is that it can represent a guarantee of approval (to travel or to invest). This fact alone is already reason enough to strategically manage a country’s brand and also its reputation.

We will now devote a little time to analysing how reputation works and its impact in the case of Spain. In general, the reputation linked to a country brand is quite complex to grasp. In the minds of stakeholders, reputation is built upon a multitude of factors of a varied nature: some are factual and fictional; others are tangible and intangible. Somehow, everything is intertwined, partly as a result of the different ways in which people form their perceptions of a country. There are three main aspects: people’s direct experiences, the actual communications from countries and the opinion of others, especially the media. Add to these the national stereotypes present in

the popular psyche. All these outputs end up generating a country’s personality and some internationally accepted perceptions.

According to the data from our country RepTrak™ 2012 study, Spain is positioned and valued, above all, for its lifestyle. We are attractive for our leisure, cultural and gastronomic offering, but also for the quality of our people and our natural environment. However, our reality is misunderstood. Spain has a highly internationalised economy, but it is not seen as a country with successful companies and brands, even though it is a leader in sectors that require highly advanced technological development, such as infrastructure, renewable energies, telecommunications, air space control, etc. Does this mean that Spain has a reputation problem (i.e. “perception”)? The answer is yes. And can the same also be said of its country brand? The answer is a definite yes. The goal posts aren’t missing. The net is missing. Or to be more precise, Spain needs a new net.

Spain has a reputation problem (i.e. “perception”)? the answer is yes

At the Reputation Institute, we have developed a specific model to manage the reputation of countries: country RepTrak™. This model quantifies and analyses the reputation of a country on three different levels. The first one measures the trust, respect, admiration and good feeling that a country generates. On a second level, the model rationalises what on the first level is nothing more than an emotional instinct from 16 reputation attributes (Is a beautiful country, Is an enjoyable country, Is an enjoyable country, Offers a favorable environment for doing business, Is run by an effective Government, Has adopted progressive social and economic policies, Is a responsible participant in the global community, Produces high quality products and services, Has many well-known brands, Is an important contributor to global culture, Offers an appealing lifestyle, Is technologically Advanced, Is a safe place, Operates efficiently, Has a well-educated and reliable workforce, People are friendly and welcoming and Values education), which the model algorithm subsequently groups into another three dimensions (in the case of country RepTrak™ these comprise: Advanced economy, Appealing environment and effective Government). The third level of analysis correlates the above attributes with a number of favourable behaviours (Visiting the country, Investing in it, Buying products or services originating in the country or Living, Studying and Working in it).

Using this model, at the Reputation Institute we have studied the reputation of Spain on two geostrategic areas of vital importance for our country brand and for our reputation, as well as for the commercial and corporate interests of Spanish companies. These areas are the G8 countries (Germany, canada, USA, france, Italy, Japan, the UK and Russia) and Latin America (Mexico, Brazil, Peru, Argentina, Chile, Colombia, Panama and Puerto Rico).

Generally speaking, and according to the information in our country RepTrak™ 2012 study, Spain has a well- differentiated image. We stand out for our “soft” attributes such as our friendly and welcoming people, attractive lifestyle and entertainment and leisure possibilities. We are therefore considered to be a good country to live in or to visit. However, we are not positively perceived as a country to work or invest in. Our image is weak in “harder” attributes such as technology/ innovation, and well-known brands and companies, quality products and services and in all matters relating to the economic environment.

The data resulting from fieldwork conducted in the general public (over 72,000 individuals were surveyed) in the G8 and Latin American countries, offer, however, some interesting nuances that are detailed below.

Spain’s reputation in the G8

For citizens of the G8, Spain is the country with the 16th best reputation in the world (57 nations were assessed). We continue to hold the same position as in 2011, only experiencing a very slight fall of 0.3 points to 63.4 points (out of 100). Our reputation is in the vicinity of those of the other big G8 powers. In fact, if Spain belonged to a hypothetical G9, it would be the country with the 5th best reputation, only behind canada, Germany, Japan and the UK.

Despite our delicate economic situation, the results of country RepTrak™ 2012 study confirm the strength of Spain’s reputation and that the euro crisis is not influencing all countries affected by it equally. Greece and Italy, for example, are two of the 57 countries analysed in the study which have experienced the greatest deterioration in their reputations. In 2012 Greece lost a total of 12.4 points, while Italy fell 5.6 points.

The strength of the reputation of our country is not only maintained against all the peripheral countries but also when compared to the average reputation of the G8 member nations. Among the french, the assessment of Spain’s reputation compared with the average of the G8 is 11% higher. This is 8% among Germans, 5% among Britons and 4% among Italians. It is even higher in the US: 1%. Only in Japan, does the G8 reputation surpass that of Spain by 5%.

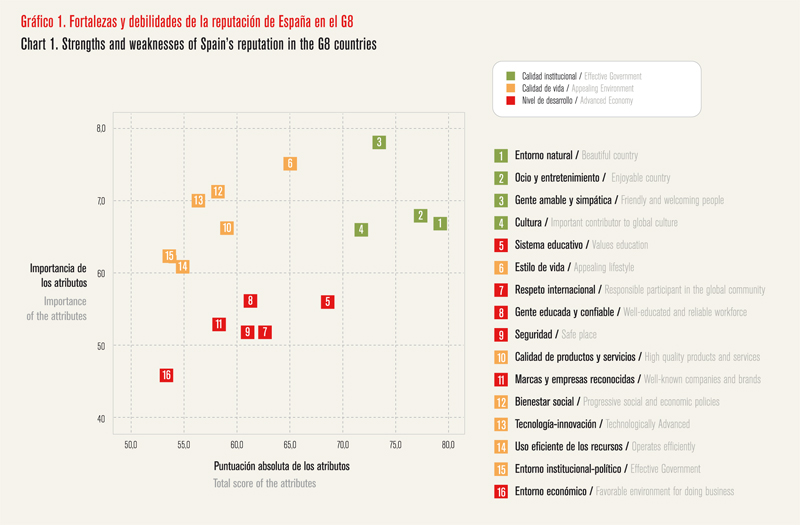

Figure 1 shows the strengths and weaknesses of Spain’s reputation in the opinion of the respondents. natural environment (79.3 points), Leisure and entertainment (77.4 points) and friendly and welcoming people (73.5 points) are our strengths, while economic environment (54 points), Technology and innovation (53.3 points) and efficient use of public resources (54.9) are perceived as our main weaknesses.

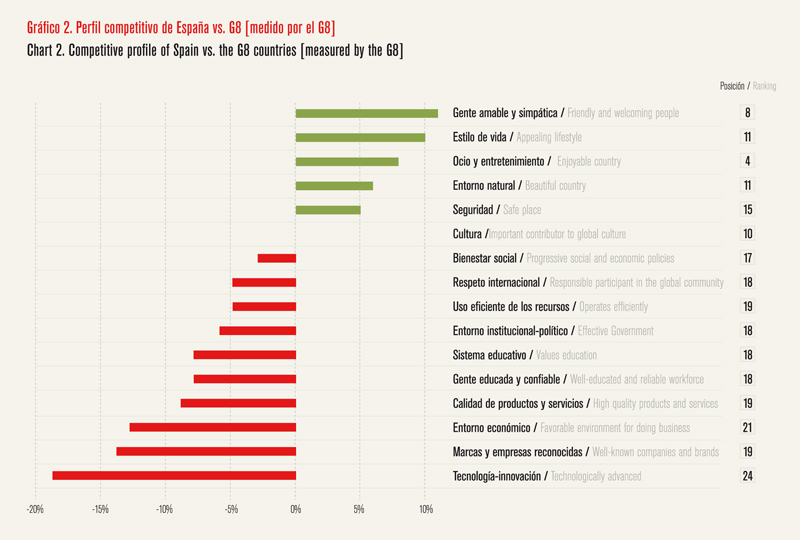

With regards to 2011, Spain’s reputation is somewhat weaker in most of the 16 attributes evaluated, contributing to the polarisation of our competitive position around the softer reputation variables. figure 2 compares the assessment of the 16 attributes of our reputation with the average of the G8 countries for these same attributes.

Spain’s reputation in Latin America

Latin American respondents surveyed awarded Spain 54.9 points (i.e. almost nine fewer than the G8) and 8th place among the 20 countries assessed. We can say that with the exception of Brazil, other Latin American countries included in the study (Uruguay, Argentina, chile, Panama, ecuador, Mexico, Peru, colombia, Bolivia and Venezuela) scored worse than Spain. In our imaginary G9, Spain would occupy 7th place, just ahead of the USA and Russia.

One of the most troubling findings of the country RepTrak™ 2012 study is that the reputation of our country in Latin America continues to decline, widening the negative differential with respect to our perception in the G8. In some countries, the assessment of Spain is downright bad. These countries are Argentina (48.16 points), chile (46.40 points), colombia (44.71 points) and Panama (41.55 points). It is in these countries where Spain’s reputation has fallen most compared to 2011: 16.9% in Argentina, 27.5% in chile and 7.5% in colombia (Panama was not included in last year’s country RepTrak™ report). Only in Mexico did our reputation improve significantly (by 2.5%). Puerto Rico is the country that most values us (72.9 points).

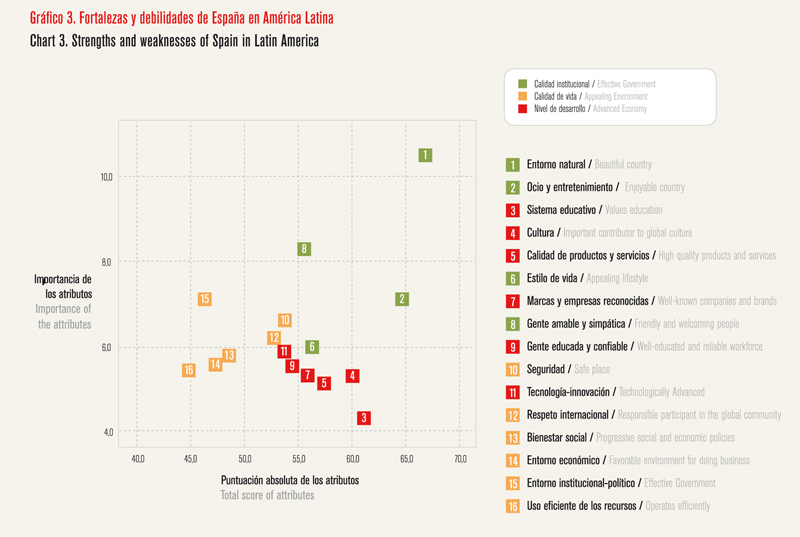

As in the G8, the attributes that Latin American citizens most value in Spain’s reputation are natural environment and Leisure and entertainment. However, what was also a stronghold in the G8, friendly and welcoming people, is a weakness in Latin America. And in contrast, Institutional and political environment (36.3 points), economic environment (47.4 points) and Social welfare (48.3 points) are our main weaknesses, as reflected in figure 3.

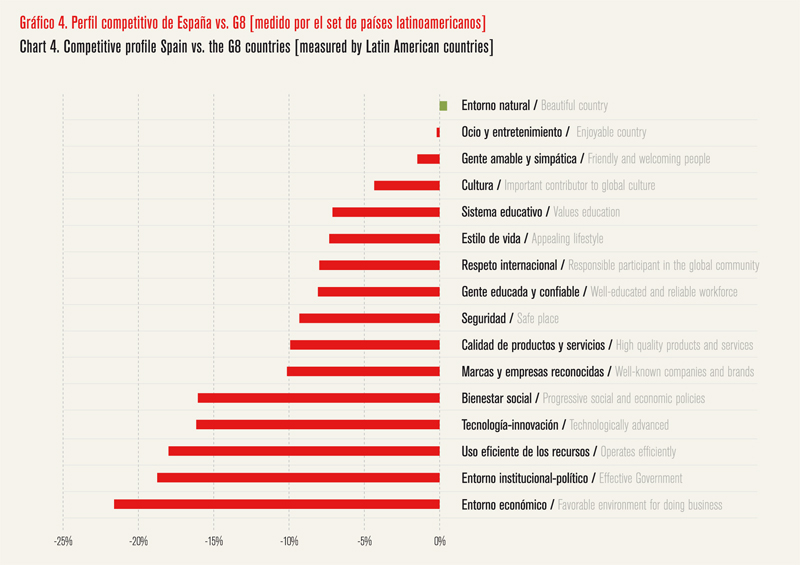

Similarly, if we carry out the same exercise in the previous section, but in this case comparing the average of the G8 attributes with the average awarded by Latin American countries to ours, the resulting competitive profile varies considerably. As shown in figure 4, the respondents only gave a competitive advantage to Spain in the attribute of natural environment. In the remaining 16 attributes assessed in the country RepTrak™ report, our competitive deficit compared to G8 deficit is important.

Undoubtedly, this negative perception of the image of Spain owes rather a lot to the effects of the economic crisis. However, a number of indicators point to structural factors and not just to circumstantial ones. It transcends the crisis. The Spanish are a friendly nation in the eyes of almost everyone … except the Latin Americans. Therefore, issues rooted in the past continue to be a problem. Probably, the stereotype of the conqueror or the new conqueror is still latent, if we think of the major Spanish companies that have invested in the region and have taken control in relevant sectors.

One final reflection

The aforementioned data could lead to despair, but it really just shows that building a country brand and a good reputation is no easy task. Often the recipe to tackle this situation is to increase investment in advertising, to promote tourism or to bid to host mega-events to ensure media interest in the country (the Olympics, etc.). Rarely, the commitment of all stakeholders involved in the country brand is based on the strategic planning that combines public- private efforts. In this context, one might wonder whether the “Spain Brand” is an asset for Spanish companies or if to the contrary, it represents a handicap for them.

Year after year, our country RepTrak™ study emphasises the same paradox (which we could definitely stigmatise as the “Spanish paradox”): we are admired for many things, – two or three years ago even for our welfare state – but under no circumstances for our technology or our businesses and brands. Why is there this dissociation between our country and our businesses?

It is not the first time that I have asked this question publicly and I still use the same argument. Here are the possible scenarios of the Spanish paradox, this dissociation between the reputation of our country and the reality of our international economy and our successful companies. One: we have major companies and brands, known worldwide, but they are not admired. Two: we have large well-known companies and international brands that are admired, but they are not identified with Spain. Three: we have companies that are large and international but that are unknown to the general public outside our country. And four: we do not have companies and brands to the level that one would expect from a country like ours.

Which of these scenarios is most likely? A combination of all of them. One: the sectors that our companies most stand out in are not exactly the best valued by the general public (except retail): banking, telecommunication, utilities, etc. Two: empirical evidence shows that Spanish brands are not associated with our country (what percentage of Japanese buyers know that Zara is a Spanish brand?). Three: there is a more or less general lack of knowledge on the identity, and even more on their nationality, of the companies in industrial or infrastructure management sectors in which several Spanish companies are world leaders. And four: unfortunately we do not have a global brand that identifies with our country such as Nokia with Finland, Ikea with Sweden.

It is time to promote a coordinated public-private initiative to develop the “Spain Brand”

How can we overcome the Spanish paradox? It is time to act, to promote a coordinated public-private initiative and to encourage other civil society institutions to develop the “Spain Brand” and to strengthen the “Made in/by Spain”. The good image of Spain can be leveraged to support our products and services, but above all to develop a common positioning for our country to provide a distinctive, positive message around which Spanish companies and institutions can create their own communication, providing consistency and coherency to fill a defined space in the minds of consumers in other countries. Without a doubt, this is the task that faces the Spain Brand project led by the High commissioner, carlos espinosa de los Monteros, along with Real Instituto Elcano and the Leading Brands of Spain forum, whose beginnings are promising.

Spain is faced with the challenge of developing a new vision for its country brand. Whether we are capable of rising to that challenge will depend, in a large part, on how we recover the path of growth and well-being, so that we can occupy our rightful place, in line with our reality and potential, in the Reputation economy.

FERNANDO PRADO ABUÍN. Managing Partner of Spain and Latin America Reputation Institute