This article was written with 2011 data

The Middle East and north Africa (MENA) includes a varied group of countries, located in a geographical area spanning from Morocco to Iran. Most of these nations belong to the Arab League, with the exception of Iran. In 2010, the region as a whole had an estimated GDP of 2.4 trillion USD and an average per capita income of 6400 USD. nevertheless, MenA countries have varying degrees of development and wealth: Qatar is one of the countries with the highest income per capita in the world (80,441 USD), while Yemen has the lowest in the region and one of the lowest in the world (1,070 USD).

The population of MENA is estimated at 350 million people, some 6% of the world’s population. The most populous countries are Egypt, with 82.5 million, and Iran, with 74 million (Data from 2011). Population growth, which has quadrupled since 1950, has slowed down, though the fertility rate is still above the world average (Global fertility rate in 2011:2.4;Middle east :2.9; north Africa: 3.1). As a result, the proportion of the younger population is very high (one in three residents is aged between 10 and 24 years). This causes significant challenges in terms of education and employment. According to the World Bank, over 50 million jobs must be created in the next decade to reduce unemployment, a goal that is far from being satisfied with an unemployment rate (It exceeds 10% with expectations of exceeding 10.5% up to 2017) that is the second highest in the world after sub-Saharan Africa (International Labour Organisation). This situation is exacerbated by high youth unemployment (26%), the poor integration of women into the labour market (18.4%) and job insecurity, with an informal sector whose share of GDP exceeds 30% in many countries, mainly in the Mediterranean area.

With regard to natural resources in MenA countries, hydrocarbons play an important role since this region produces 40% of the world’s oil and has 60% of global oil reserves, in addition to important gas reserves. Thus, four of the ten largest oil producers are in MENA (Saudi Arabia (1), Iran (4), UAe (8), Iraq (9) and Kuwait (11). Source: Cia World Factbook 2011) and six of the countries in this region are in the top ten ranking of countries with the world’s largest proven reserves (Saudi Arabia (1), Iran (3), Iraq (4) Kuwait (5), UAe (6) and Libia (9). Source: Cia World Factbook 2011). The exploitation of hydrocarbons has developed a major petrochemical industry in oil producing countries – especially in the Gulf. Logistics and transport services also have an important contribution to their economies. In these countries, the government has a large stake in the economy, and in terms of economic openness the Gulf stands out, while Algeria and Iran are much more closed.

As for the oil importing countries (Egypt, Jordan, Lebanon, Mauritania, Morocco, Syria, Tunisia and Djibouti) these have created open market economies abroad, especially to the eU as a main trading partner, and with which agreements have been reached to create free trade areas. Some countries, such as Tunisia, Jordan and Morocco, have a high degree of association with the eU and the latter scored advanced partnership status in October 2008. nevertheless, in these countries the public sector still plays an important role and they share, with the other countries of the region, the need to diversify their economies and to encourage the private sector to create jobs and stimulate their economies.

MENA is also characterised by a low level of economic integration, though it does have two economic organisations, the Arab Maghreb Union (UMA: created on 17 february 1989 with its headquarters in Rabat, its unrealised goal was to establish a common market in 2006. Member countries: Algeria, Morocco, Libya, Mauritania and Tunisia) and the Gulf cooperation council (GCC: created on 25 May 1981. Member countries: Saudi Arabia, Bahrain, the UAe, Kuwait, Oman and Qatar), which pursue economic integration and promote free trade. A pact was also made within the Arab League, called the Greater Arab free Trade Area (GAFTA: Signed on 1 January 2005 by 18 countries in the Arab League) and the Agadir Agreement (Signed on 25 february 2004 by Jordan, Egypt, Tunisia and Morocco to create a free trade area) promoted by the eU. Of all these initiatives, the most advanced is the Gcc, which created a customs Union in 2003 and a common market, which came into effect on 1 January 2008. Still, its intraregional trade does not reach 15%, far below that of other economic areas (Association of Southeast Asian nations (22%), economic community of West African States (20%), although it exceeds that of the Maghreb, which does not exceed 3%. It should be noted that within the GCC electricity and rail connection projects are being developed that will promote integration, although the project to create a common currency, initially for 2010, is still on hold, their economies are based on manufacturing, services (tourism) and agriculture.

From the financial crisis to the Arab Spring

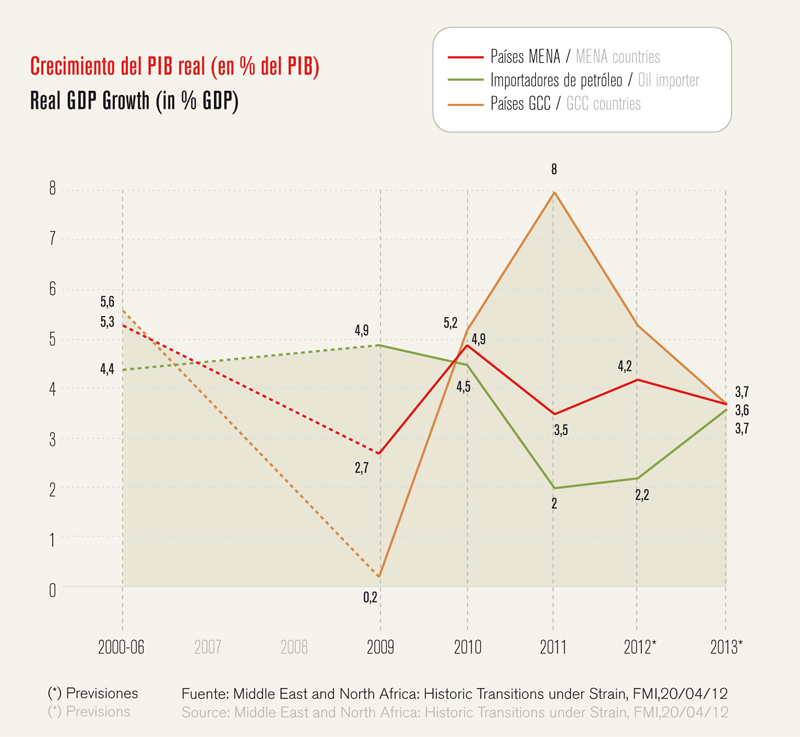

The past years have proven rather turbulent ones for the region, both politically and economically. The 2008 financial crisis, together with the fall in oil prices, has had a negative impact on the oil producers. This situation was exacerbated by the collapse of the property sector in Dubai, causing significant losses in MENA financial markets. Today the crisis is considered to be over in Dubai, and the Abu Dhabi bailout12 has fostered better integration in the UAe. After this crisis, the region resumed its growth path and regained the levels of growth it enjoyed at the beginning of the decade. This trend was later to be disrupted by social and political movements that began in December 2010 and which have been called the ‘Arab Spring’.

This phenomenon, which has led to the demise of four governments, started two wars and many political changes – most notably the rise to power of Islamist parties in Tunisia, Morocco and Egypt – has had serious economic consequences (According to the Arab Tourism Organisation, the riots as a whole caused in 2011 losses within the region of USD 96 billion in the area. Of this total, 18% was incurred in the tourism sector). The transition to democratic regimes has not been an easy road and socio-political instability has worsened the economic problems that were, in part, the cause of the riots. This situation is compounded by the uncertainty generated by the stabilisation of Libya and around the future of Syria, a country whose internal conflict is affecting neighbouring countries. Moreover, governments have increased their spending to try to pacify social demands and this has worsened the situation of public finances in some countries. Thus, the public deficit of oil-importing countries will be equal to 8.3% of GDP in 2012 and to 6.85% in 2013 according to the IMf. This same body suggests that 0.9 trillion USD of funding will be required in 2012 and 1 trillion in 2013. Still, a GDP growth in the region in both years is still forecast.

This growth is expected because the Gcc countries, spurred by the evolution of oil prices, will continue to grow and to support the countries of the Arab Spring to which they have pledged aid of over 13 billion USD. The volume of its investments in other Arab countries is also noteworthy: 17.54 billion USD in 2011, in a context of distrust that caused a decrease of 16% in foreign investment. It should be noted that the crisis in some euro zone countries is affecting these countries also as a result of the reduced remittances from emigrants, the drop in tourism and the decline in exports in countries with high dependence on european demand.

Nevertheless, while the economic situation in some countries seems difficult in the short term, once institutional stability is achieved in Tunisia and egypt and the basis for the reconstruction of Libya is settled, regional prospects will improve and growth will gain momentum (Provided that the crisis over Iran’s nuclear programme is resolved peacefully). In this sense, regional prospects in the medium term are improving and the IMf forecasts the regional GDP to reach 3.6 trillion USD in 201615. for these forecasts to materialise, support from the international community for the transition process will be critical.

Business opportunities for Spanish companies

Trade exchanges between Spain and countries in the Middle east and north Africa is very important for Spain because, after the eU, it is the second largest region in terms of volume of trade. Thus, if we take a look at the period 2007-2011, the value of our trade with this region was estimated at 361.23 billion euros, exceeding the value of trade with Latin America, north America and east Asia, which together amounted to 328.03 billion in the same period. Such a high figure is due to the concentration of Spanish imports of hydrocarbons and important economic relations with north Africa, mainly Morocco and Algeria, who are our main trading partners in the region. Our trade with north Africa in this period was estimated at 97.103 billion euros, exceeding trade with north America (55.13 billion), and is just slightly lower than trade with Latin American countries (113.13 billion). nevertheless, although trade has increased significantly in the Maghreb in the last decade, in particular with Morocco, it is still below its potential. With respect to the Gulf countries, Spanish business activity has increased dramatically over this period, mainly in the UAe and Saudi Arabia.

There are Spanish companies working on emblematic projects in the region

Despite the turmoil and difficulties in some MenA countries, Spanish companies must include this region as a priority in their economic strategies. Sectors such as construction, transport or energy cannot ignore the large projects planned in the region and these can be viewed as a way to offset their difficulties in the domestic market. In fact, it is expected that 25% of global investment in power up to 2020 will be made in this area (estimated at 1.1 trillion USD by Booz & Company), and not only in traditional energy but also in renewables. In construction, in the GCC alone, there are projects in the pipeline worth $2.5 trillion up to 2020 (according to the Gulf Organization for Industrial consulting (GOIC). Moreover, in terms of transport infrastructure, it is one of the most active regions in the world (Rail projects alone that are either planned or underway are estimated at USD 157 billion).

The tourism sector also offers good prospects and, despite the difficulties encountered in 2011, more than 81,452 hotel rooms are planned for the region, a figure that must be added to the 62,636 that are already under construction (According to STR Global see Meed 13-19/04/12). This sector has tremendous potential as it is vital for non-oil producing countries and is a means of diversification for producers. furthermore, some countries, such as Algeria and Libya, have excellent conditions for tourism in which the Spanish experience could contribute to the development of an untapped sector. And we must not forget the major Qatar’s infrastructure plans for hosting the 2022 World cup or Algeria’s economic programme (The public investment programme for 2010-2014 is estimated at 212 billion euros), or the opportunities that are emerging in a much more stable Iraq (See article ‘¿Es posible hacer negocios en Iraq?’, Boletín de economía y negocios de casa Árabe no. 26, 06/10/11). This is all occurring in a region with which we share historical and cultural ties that open the way to forging business cooperation. In this sense, there are Spanish companies working on emblematic projects such as the Haramain high-speed railway line in Saudi Arabia or the contract for the construction of a mega thermal-solar plant recently obtained in Morocco. This project will be an addition to others already in operation, such as the first hybrid solar-gas plant in Algeria or the Gemasolar plant, built in Spain by a Spanish- UAE joint venture.

It should be noted that Spanish companies such as Técnicas Reunidas, Isolux corsán, fomento de construcciones y contratas (fcc), Indra, ferrovial and Typsa are well- known in the region for their expertise in working on large-scale engineering and construction projects in a variety of sectors. In the traditional energy sector, important players include Repsol, Cepsa, Gas Natural Fenosa, and in the renewable energy sector mention must be made of Acciona, Abengoa, Iberdrola, Gamesa, Sener and MTorres, which have major projects underway in the region. In other areas, such as transport and logistics, the activity of Alsa, Irizar, San José López and CAF are particularly noteworthy. In tourism, the presence, especially in north Africa, of hotel chains such as Barceló, AC Hotels, RIU and Sol Melià is remarkable. Likewise franchises in the sectors of fashion (Inditex, Mango, Cortefiel, Pronovias, Blanco, Springfield, Neck & Neck, Joma Sport, Desigual, Camper, Roberto Verino, Adolfo Domínguez) furniture (Merkamueble) and food (Lizarrán, Telepizza) have a strong presence in the area, especially in the Gulf countries, which are high consumption markets.

It should be noted that Spanish companies such as Técnicas Reunidas, Isolux corsán, fomento de construcciones y contratas (fcc), Indra, Ferrovial and Typsa are well- known in the region for their expertise in working on large-scale engineering and construction projects in a variety of sectors. In the traditional energy sector, important players include Repsol, Cepsa Gas Natural Fenosa and Cepsa, and in the renewable energy sector mention must be made of Acciona, Abengoa, Iberdrola, Gamesa, Sener and MTorres, which have major projects underway in the region. In other areas, such as transport and logistics, the activity of Alsa, Irizar, San José López and CAF are particularly noteworthy. In tourism, the presence, especially in north Africa, of hotel chains such as Barceló, Ac Hotels, RIU and Sol Melià is remarkable. Likewise franchises in the sectors of fashion (Inditex, Mango, cortefiel, Pronovias, Blanco, Springfield, Neck & Neck, Joma Sport, Desigual, camper, Roberto Verino, Adolfo Domínguez) furniture (Merkamueble) and food (Lizarrán, Telepizza) have a strong presence in the area, especially in the Gulf countries, which are high consumption markets.

References

- Economics and Businesses Portal casa Árabe

- Middle east and north Africa: Historic Transitions under Strain, IMf, 20/04/12

- Arab World competitiveness Report 2011-2012, Wef & OecD, 27/01/12

- Global employment Trends 2012: preventing a deeper jobs crisis, ILO, 24/01/12

- Ahmed Galal y Jean-Louis Reiffers (coords.), “Towards a new Med Region: Achieving fundamental Transitions”, feMISe Report on the euro-Mediterranean Partnership 2011, 04/11/11

- The Role of Large employers in Driving Job creation in the Arab World, World economic forum, 2012

- Moustapha Rouis, Arab Donors’ early Response to The Arab Spring, World Bank, QnS, no. 69, 07/12

- Mthuli ncube and John c. Anyanwu, Inequality And Arab Spring Revolutions In north Africa and The Middle east, AfDB,07/12. z

ANA GONZALEZ SANTAMARÍA. Training, Economics and Business, Casa Árabe.