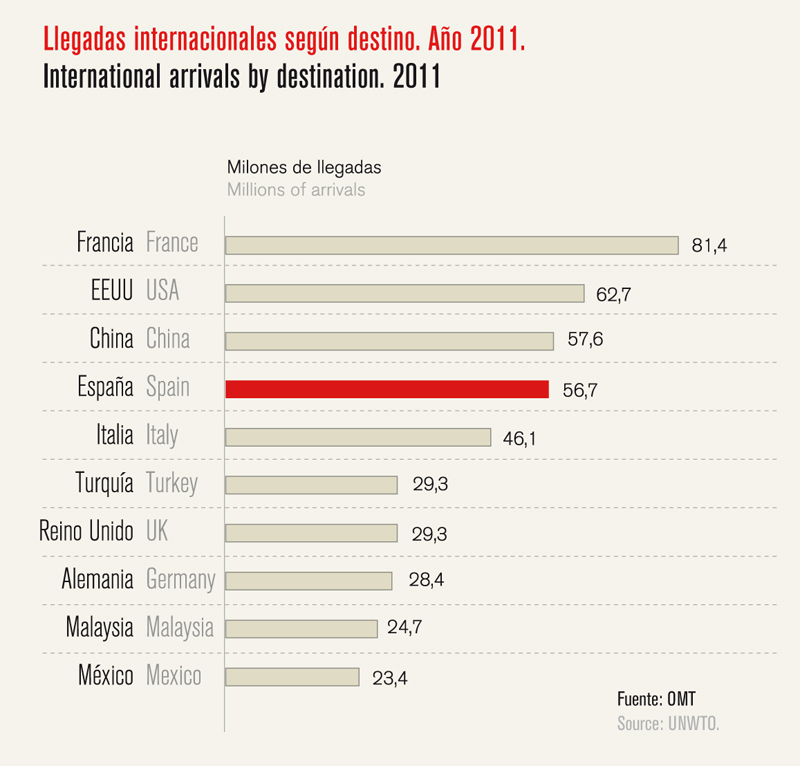

Spain is one of the most popular tourist destinations worldwide, occupying fourth place in 2011 in the world ranking of tourist arrivals, behind france, the US and china. In terms of tourism revenue (Balance of Payments), it has moved up two positions, ranking second after the United States. This situation improves when talking about the balance of net income and payments for tourism, where Spain leads the world rankings, with 42.6 billion dollars.

The physical environment positively influences the choice of Spain as a tourist destination. The country has 108 days per year of temperatures above 25 degrees, 2,451 hours of sunshine, which is equivalent to 6.7 hours of daily sun. It boasts 8,000 km of coastline, and the highest number of Blue flag beaches in the world. Moreover, 24% of Spanish territory is classified as a protected area, coming third in the european ranking. Moreover, Spain has a total of 44 world heritage monuments and sites, making it the second country in the world in terms of this factor, preceded only by Italy, which has 47.

As far as infrastructure is concerned, Spain has somewhere in the region of 2,000 km of commuter rail lines and 2,900 km of high- speed rail network, which makes it the first country in this respect in europe and second in the world, after china, in terms of the number of high performance rail kilometres in operation. It even beats countries with a long tradition in this mode of transport, such as Japan and france.

Spain has 47 airports managed by Aeropuertos españoles y navegación Aérea (AenA), and is the third european country in terms of the volume of passengers transported by air, after the United Kingdom and Germany. In addition, three Spanish airports, Madrid-Barajas, Barcelona and Palma de Mallorca, are in the european ranking of the 15 busiest airports, Madrid- Barajas coming in at number four.

At the same time, it is the european country with the highest number of kilometres of high-capacity roads: 14,262 km. In terms of length of roads per squared km of surface it is in eighth place, above the european average.

The range of hotels available also positions Spain in a good place because the 1.8 million hotel beds available has nudged it into second place at a european level, and the fourth in terms of the number of establishments.

Meanwhile, Spain’s presence in terms of hosting international meetings is also apparent. It is the third top destination worldwide for number of meetings held and Barcelona and Madrid are in the ranking of the top 10 cities.

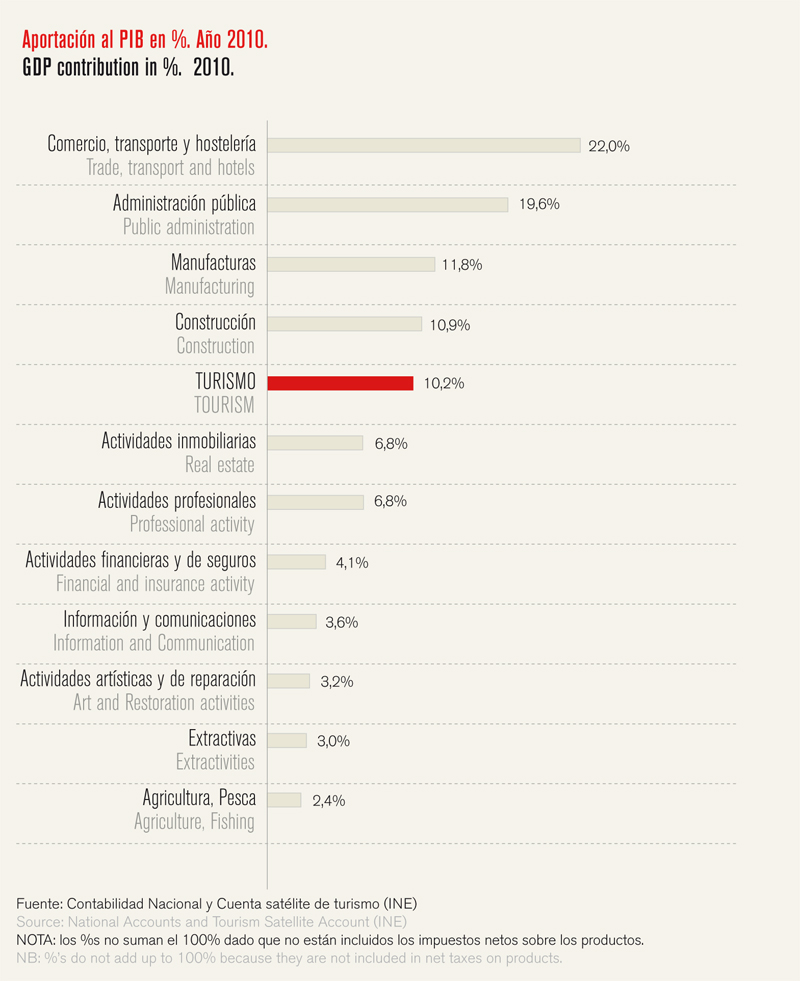

From the point of view of tourism’s contribution to the Spanish economy, the Tourism Satellite Account allows us to measure the importance of tourism activities on the economy as a whole, representing in 2011 (the latest available data), 10.8% of GDP, which translates to 114,965 billion euros. This places tourism as the fourth most important activity in the Spanish economy. However, we must bear in mind that tourism, being a transversal activity, is also part to of, to a greater or lesser extent, other activities, such as industry, services and even construction and governmental services.

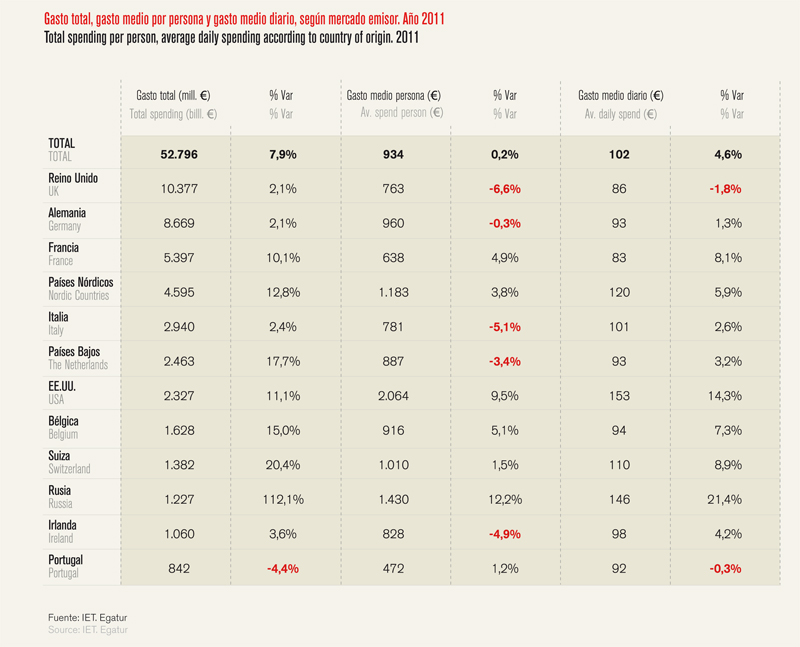

The analysis of inbound tourism in 2011 shows that Spain has been the choice of 56.7 million international tourists, which meant an increase of 7.6% over the previous year. Meanwhile, tourism spending amounted to 52.796 billion euros, a year-on- year increase close to 8%. As noted, growth in spending has been slightly higher than that experienced in the number of tourists, which has caused a slight increase in tourism spending per person to about 933.6 euros. Meanwhile, the average daily spend totalled 101.9 euros, a year-on-year growth of 4.6%, a result of shorter average stays.

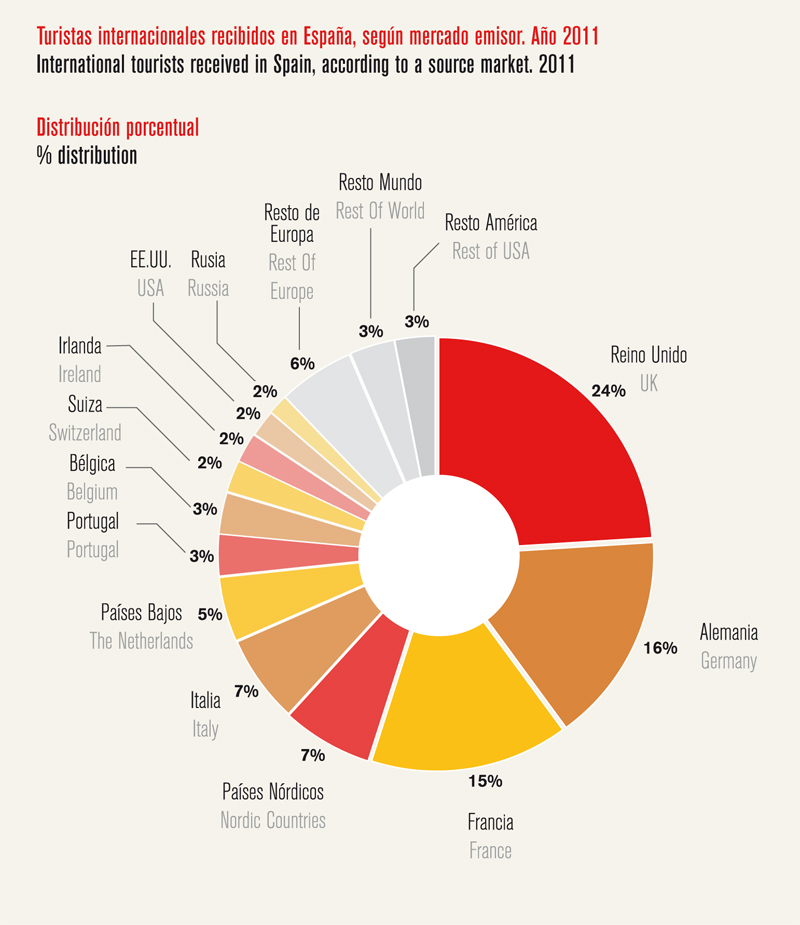

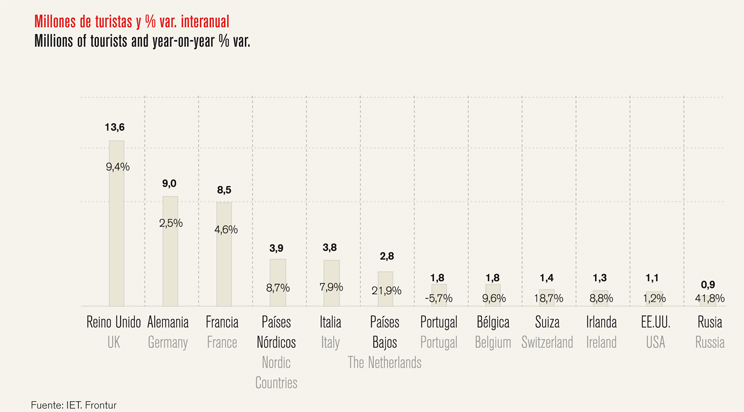

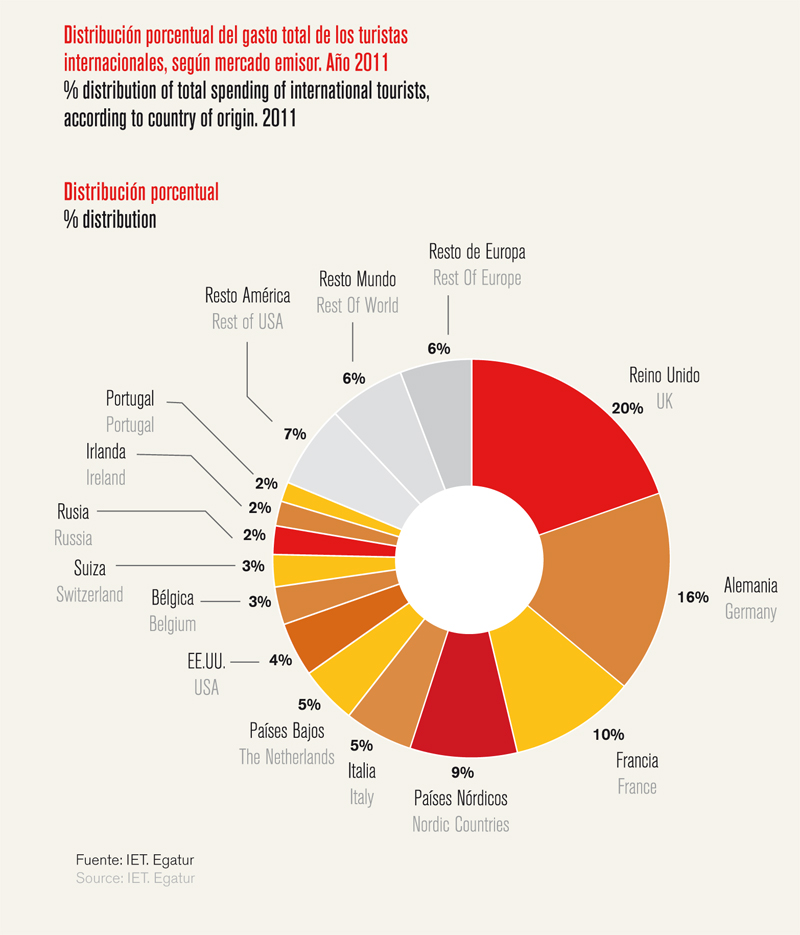

As usual, the main countries of origin were the United Kingdom, Germany and france, which together totalled about 55% of tourist arrivals in Spain in 2011. They all evolved favourably compared to 2010, although the UK showed the biggest rise, becoming the market that contributed most this year to inbound tourism in Spain.

The nordic countries, which together account for 7% of tourist arrivals in Spain, and Italy, also weighing close to 7%, come in next, both recording year-on- year increases. Special mention should be made of the netherlands, with almost 500,000 more tourists crossing our borders in 2011. It is one of the markets that most contributes to the positive evolution of the year. Russia, weighing close to 2%, stands out for its significant rise in 2011, 42%, adding 253,000 tourists to the year’s growth. This rise was preceded by six years of strong growth, with the exception of 2009. This affects the diversification of countries of origin and means there is less reliance on traditional markets. The most popular destination for Russian tourists was catalonia, which accounted for about 58% of arrivals.

Analysing non-european markets, the favourable performance of Latin America is clear, contributing 202,000 tourists to the year’s growth, particularly Brazil. north African markets also stand out, with an extra 241,000 tourists, as do Asian markets, particularly china, South Korea and Turkey, generating more than 195,000 tourists in 2010 among the three. non-european markets accounted for about 8% of total arrivals and all the previously mentioned markets together represent 6%.

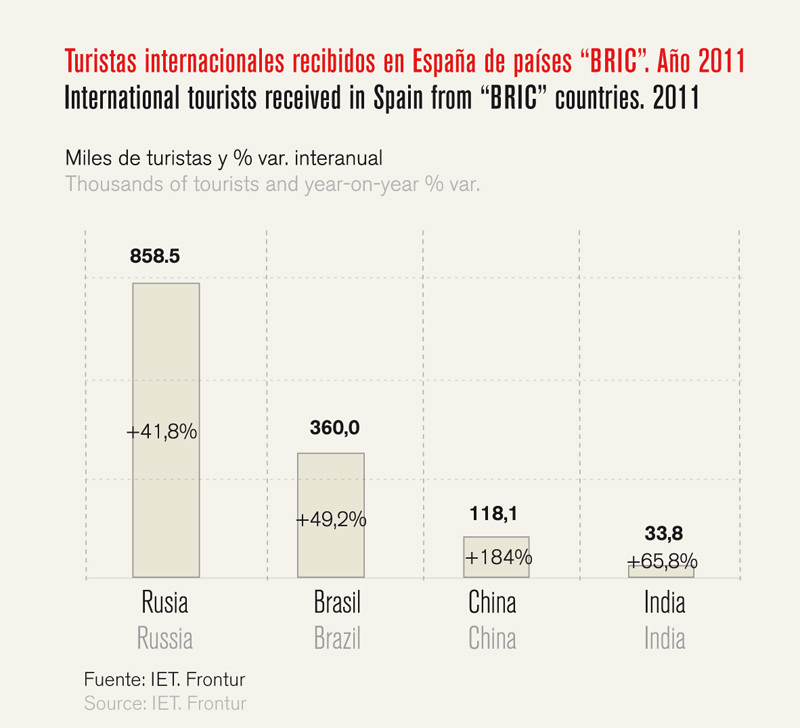

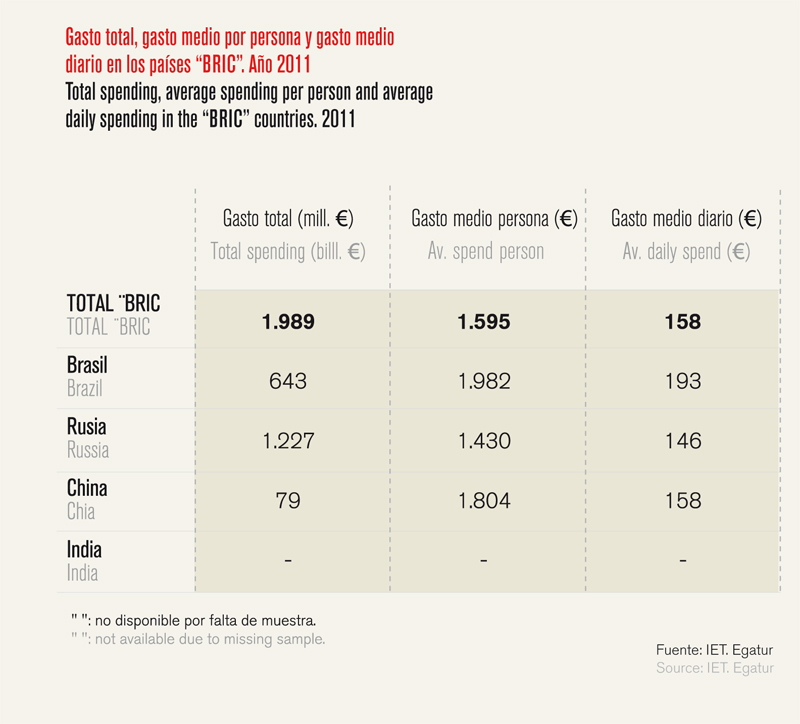

When isolating the “BRIc” countries (Brazil, Russia, India and china), the volume of arrivals is less than one million tourists in each market but annual growth rates are very high, particularly that of china. Russia and Brazil are the markets in this group that contribute most to the growth of inbound tourism in Spain in 2011. This trend has continued throughout 2012 in the case of Russia, which exceeds one million arrivals and is the source of 330,000 tourists in the cumulative increase in the period.

Regarding the destination autonomous regions, the six major ones (catalonia, canary Islands, Balearic Islands, Andalusia, Valencia and Madrid) account for nearly 92% of arrivals. In 2011, increases were noted in all of these, except for Madrid, which remained constant. The strong expansion of the canary Islands is worth pointing out as a region that absorbed almost 40% of total growth, followed by the Balearic Islands and Catalonia.

As occurs with the number of tourists, the markets with highest tourist spending in Spain are the UK, Germany and france. However, the countries that have contributed most to the growth of spending in 2011 were Russia, Scandinavia and france. Also noteworthy is the contribution of Latin American countries.

Regarding the average daily spend, all european markets show increases, excluding the UK, where it fell by 2%, and Portugal, which remains stable. Russia, the nordic countries and Switzerland all have the highest daily spending, above the average. Among the other countries of origin, the US stands out where spending rose by double digits.

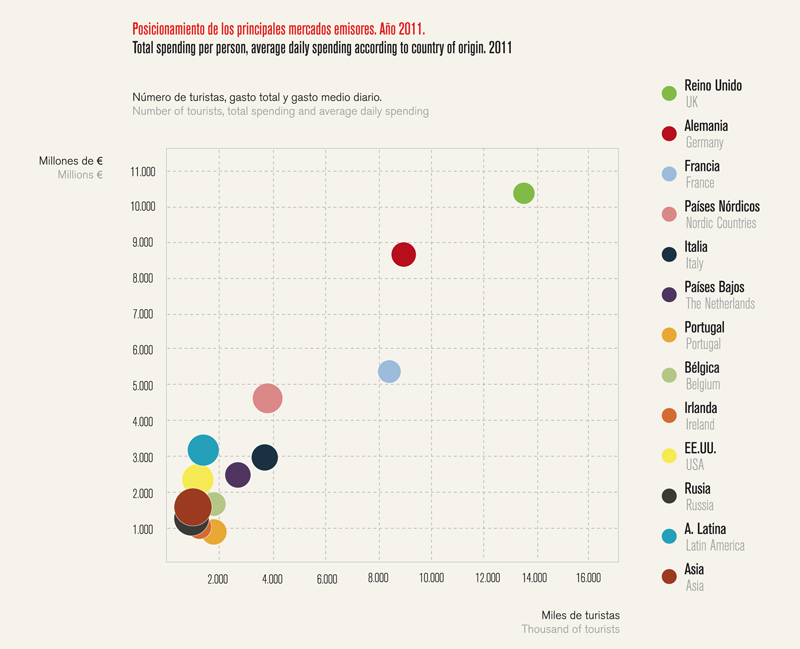

The graph below illustrates the positioning of the various countries of origin depending on the volume of arrivals and spending. The three main markets distance themselves from the rest, though france, which in number of arrivals is not too far from Germany, is not far off the nordic countries in terms of spending. In turn, Latin America exceeds Italy and the netherlands in spending and the netherlands is almost equalled by the United States.

In “BRIC” markets high average daily expenses are observed which exceed in all cases those registered by the european markets, especially in Brazil, where tourists spent almost 200 euros per day during their stay in Spain. However, distant markets are subject to higher transportation costs, due to the long distances they have to travel.

Spain is a typical holiday destination, where leisure and holidays (84%) are the main motivations for the majority of arrivals. This group has gained ground in terms of other reasons for travelling such as business and personal reasons (visiting family, health and shopping), with respective weights of 7% and 5%.

The relevance of leisure and holiday in the UK, Germany and the nordic countries is evident, representing more than 90% of arrivals. In france and Italy, leisure ranged between 76% and 78%. Business travel stands out in Portugal and Italy, especially in the former, while visiting family and friends, health and shopping trips were more important in france and Portugal.

The airport, the main gateway for international tourists in 2011 is the only means that has evolved positively, with a significant increase of 10%. Road access, the second gateway in terms of volume of arrivals, representing 18%, remained stable compared to 2010. Both ports and rail, with about 3% of tourists, individually recorded decreases, particularly the latter.

Air transport had a higher prevalence among arrivals from the nordic and British markets, used in over 95% of cases. In Germany, 91% of tourists opted for air travel. Italy and france, closer markets with better communications networks with Spain, use air travel to a lesser extent, particularly the latter. Among other gateways, the use of boat travel stood out among Italians.

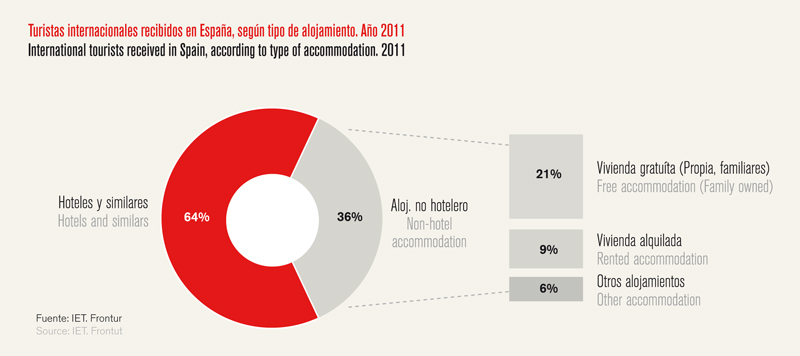

The majority of tourists visiting Spain stay in hotels (64%), which in 2011 accounted for most of the increase registered by international tourists. non- hotel accommodation also increased, although to a lesser extent (5%). Rented accommodation evolved in the most positive way. Within this latter group, own homes or those of family or friends had the most significance (21%).

Hotel accommodation stood out among German, nordic and Italian tourists, with approximately 70% of arrivals. france was situated on the other side of the spectrum, where more than half of the tourists opted for non-hotel accommodation, above all for housing of relatives or friends. The British case is somewhat similar to the average, with 62% of tourists staying in hotels and 38% in other accommodation.

69% of the tourists who visited Spain in 2011 previously opted not to contract a package holiday, a travel option that has been gaining ground rapidly compared to the package holiday in recent years. However, the latter made significant progress this year some 12%, breaking the downward trend of previous years.

The nordic countries, Germany and the UK are at the forefront of countries that opt for package holidays to travel to Spain. In the opposite corner are the closer markets.

The degree of tourist satisfaction is high. In 2011 the perceived overall satisfaction was remarkably high, reaching an average score of 8.5 points on a scale of 0 to 10. Assessing the various products, the results have also been very favourable, with average values of about 8 points, slightly above the figure recorded in 2010.

Among the main tourist countries of origin, the overall satisfaction was highest among the British with an average of 8.7 points.

Germany and the UK were the countries that best rated the accommodation (hotels, apart-hotels, hostels, rural housing and other group accommodation), with 8 points. The United Kingdom was the country that most enjoyed the gastronomy, awarding it 8.2 points, ahead of france, which was the country that best scored this concept last year. The perception of the level of infrastructure (roads, telecommunications, airports, etc.) was very positive, with Portugal awarding the highest score (8.4 points). The British, German and Italian market gave the tourist environment (natural beauty, tranquillity, safety, cleaning, etc.) a mark higher or equal to the average.

Russia and Latin America, markets that have excelled for their spectacular progress in volume of arrivals, show an above average degree of satisfaction in Spain, awarding it 9.1 points.

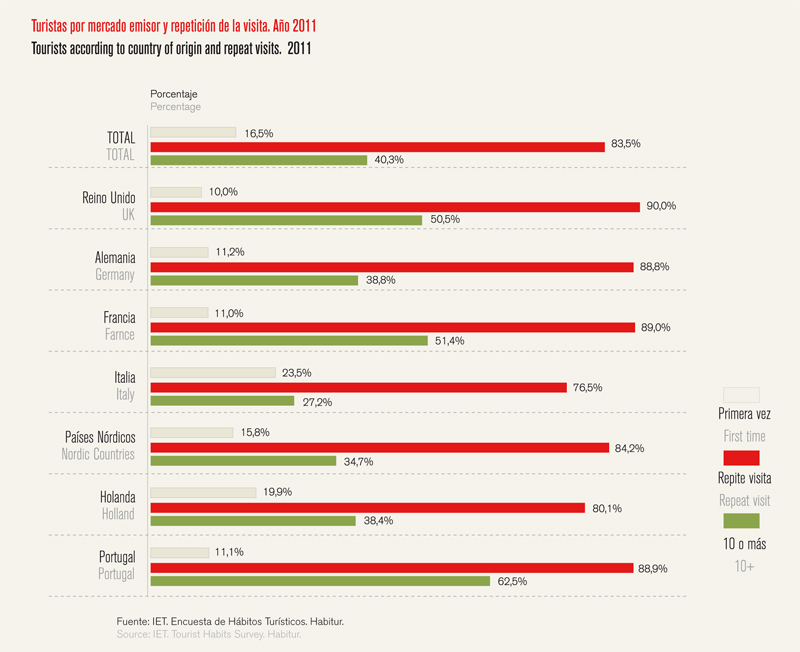

Spain also welcomes tourists with a high degree of loyalty to the destination, measured as the number of times the international tourists have been to Spain before. In 2011, the vast majority – 83.5% – had already visited previously and 40% had done on ten or more occasions.

Breaking down the data according to country of origin, it can be seen that Britain has the highest concentration of tourists who repeat their visit, with a percentage of 90%. france and Germany follow, with similar percentages close to 89%.

The high percentage of tourists who have visited over ten times is also noteworthy: 62% of Portuguese tourists and 51% of both french and British tourists.

The loyalty and fidelity of tourists gives the destination stability, as it does not depend solely on the arrival of new tourists, instead a cumulative effect is produced (tourists who return), which ensures steady revenues. The degree of satisfaction felt by foreign tourists visiting Spain is a key factor for achieving and maintaining the loyalty expected on their part, as opposed to the alternative of other competing destinations in subsequent trips.

Therefore, it can be concluded that Spain is a destination that is well positioned internationally, with natural resources and an enormously attractive physical environment for international tourists and with infrastructure and a tourist offering that more than caters for the needs of all visitors. However, we must not ignore the tremendous growing force of some emerging markets, nor should we ignore the fact that tourism in Spain has suffered a significant loss of competitiveness in recent years. This reality requires the adoption of key actions to activate growth on solid foundations that ensure the leadership and competitiveness of our model.

57.7 million tourists in 2012

According to the latest data published by frontur, in 2012 Spain received 57.7 million international tourists, which meant it closed the year with a 2.7% rise in the volume of arrivals, thus reinforcing the important progress made in 2011 (7.6%), increasing the number of international arrivals for the third year running.

The markets that have contributed to this positive result were france, Germany and Russia; the UK market remained stable, a source of 24% of arrivals. The netherlands and Italy are on the opposite side of the scale, with falls of 8.1% and 5.1%, respectively. The USA, Latin America and the Asian market, in particular china, stand out for growth among the non-european markets.

Taking a look at the autonomous regions of principal destination, catalonia received the bulk of the increase in 2012, with 1.3 million tourists more than the previous year. The Balearic Islands also received more tourists than in 2011, 3.3% to be exact. figures for arrivals in the communities of Valencia and Madrid remained similar to the previous year, while in Andalusia and the canary Islands the figures fell, the latter only moderately.

Tourist spending reached 55.594 billion in 2012, 5.7% more than in 2011. As total spending grew at a faster rate than the inflow of tourists, the average spending per person per day grew.

According to markets of origin, and in response to the major markets, in 2012 major increases were noted in the nordic countries, the UK and Germany, while Italy (-5.8%) and france (-3.2%) fell.

Spending in the regions of principal destination has grown, in general, more than tourist arrivals. In this period, total spending in the community of Madrid dropped whereas catalonia, Valencia and Balearic Islands registered year-on-year increases above the national average (5.9%).

MANUEL BUTLER. Managing Director of Turespaña.